The Employees’ Provident Fund (EPF) is a social security and retirement fund scheme in India. Administered by the Employees’ Provident Fund Organization (EPFO), it is a mandatory savings scheme for salaried employees of public and private organizations in India.

Under the EPF scheme, both employees and employers contribute a percentage of the employee’s salary towards the EPF account. This fund accrues interest and serves as a financial safety net for employees during retirement or in case of emergencies.

However, it also offers withdrawals for various purposes, such as housing, medical expenses, and education. Let us learn how to withdraw your PF amount and what are the valid reasons for the same.

Reasons for PF Withdrawal

In India, employees can make PF withdrawals for various reasons, including:

- Full and Final Settlement: If you are leaving a job permanently, you can opt for a full withdrawal of your PF balance. This is applicable when you are not planning to work in any establishment covered under the EPF scheme for two months or more.

- Partial Withdrawal for Specific Purposes: You can make partial withdrawals for specific purposes like medical treatment, house construction/purchase, home loan repayment, education, marriage, or financial emergencies. The specific circumstances and amounts vary for each purpose.

- Pre-Retirement Withdrawal: If you are nearing your retirement age, you can withdraw a portion of their PF savings to meet financial needs before the official retirement date.

- Retirement: When you retire from active service after attaining the age of 58 or above, you can opt for a full withdrawal of your PF balance.

- Migration to a New Country: If you are moving abroad permanently and are not planning to work in an establishment covered under the Indian EPF scheme, you can apply for PF withdrawal.

- Death of Employee: In case of your death, your nominee or legal heir can claim your PF balance.

- Absence from Work: If you have been absent from work for a continuous period due to physical or mental health reasons, you can apply for PF withdrawal. This usually requires a medical certificate.

Different Methods of PF Withdrawal

In India, you can withdraw from your PF in three different ways: offline, through the EPFO website, and using the UMANG app. The processes for PF withdrawal vary based on your reasons for withdrawal and the mode of application, along with your employment status, the organization you worked for, and the specifics of your PF account.

Withdrawing PF Offline

If you have a valid reason and are eligible to apply for PF withdrawal offline, you can follow the stepwise procedure outlined below:

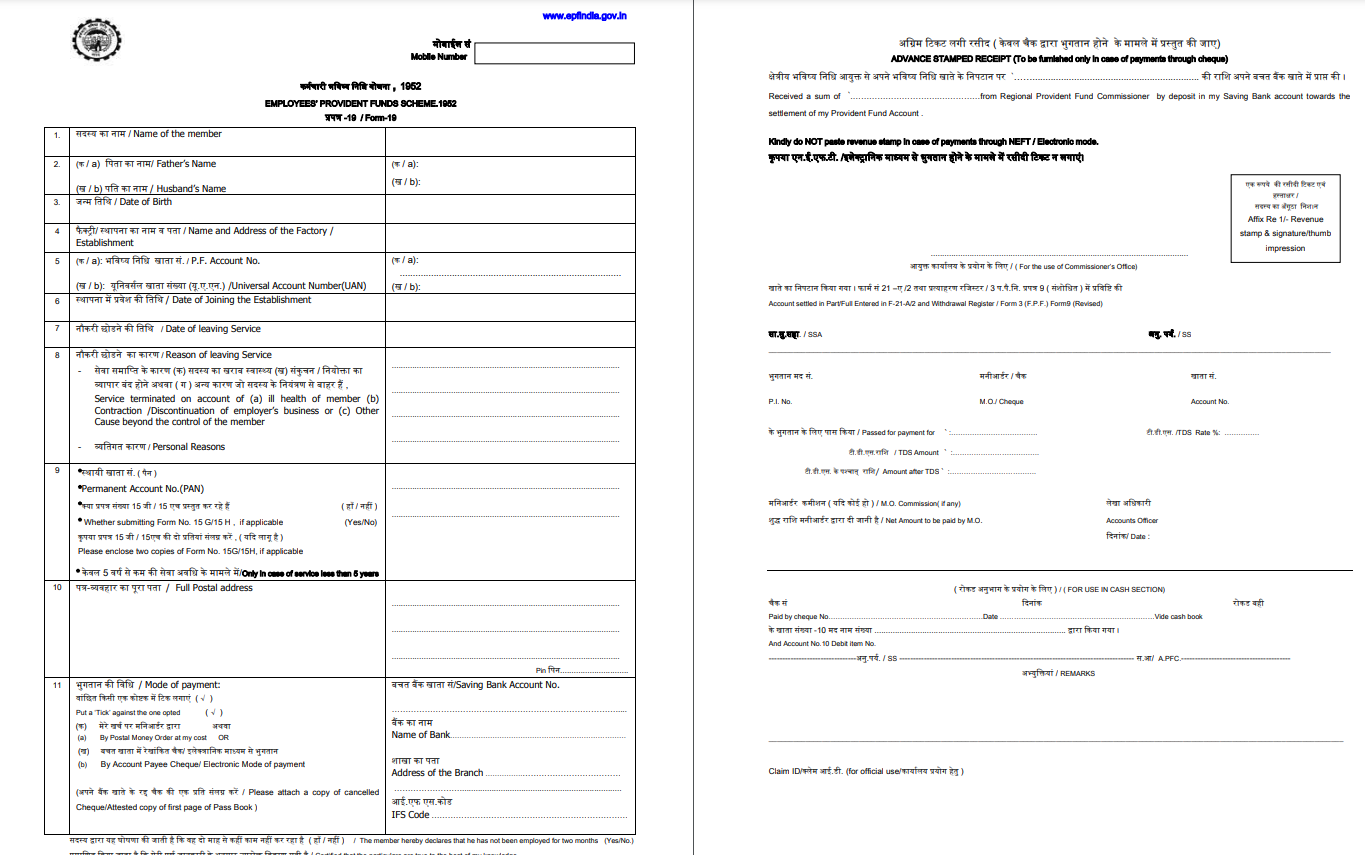

Step 1- Obtain the PF withdrawal form: If you are a member of the Employees’ Provident Fund Organization (EPFO), you can download Form 19 (for PF withdrawal) from their official website.

Step 2- Fill the Form: Fill in the required details in the form accurately. This includes your personal details, PF account number, date of leaving the job, reason for leaving, bank account details, and contact information. In some cases, your previous employer’s attestation may be required on the form. Make sure to get it signed and stamped by your employer.

Step 3- KYC: Attach a copy of your Aadhaar card, PAN card, and bank passbook/cancelled cheque as KYC documents. This will help in verifying your identity and bank account.

Step 4- Submit the Form: Submit the filled and signed form along with the necessary documents to your regional EPFO office. You can locate your nearest EPFO office using the EPFO office locator provided on the website.

Step 5- Processing Time: The processing time for PF withdrawal can vary. Generally, it takes around 15-30 days, but it might take longer in some cases, depending on the circumstances.

Step 6- Approval and Payment: Once your application is approved, the PF amount will be transferred to the bank account mentioned in your withdrawal form. You will receive a confirmation message on your registered mobile number/mail.

Withdrawing PF Amount from the EPFO Website

To apply for online PF withdrawal, follow these steps:

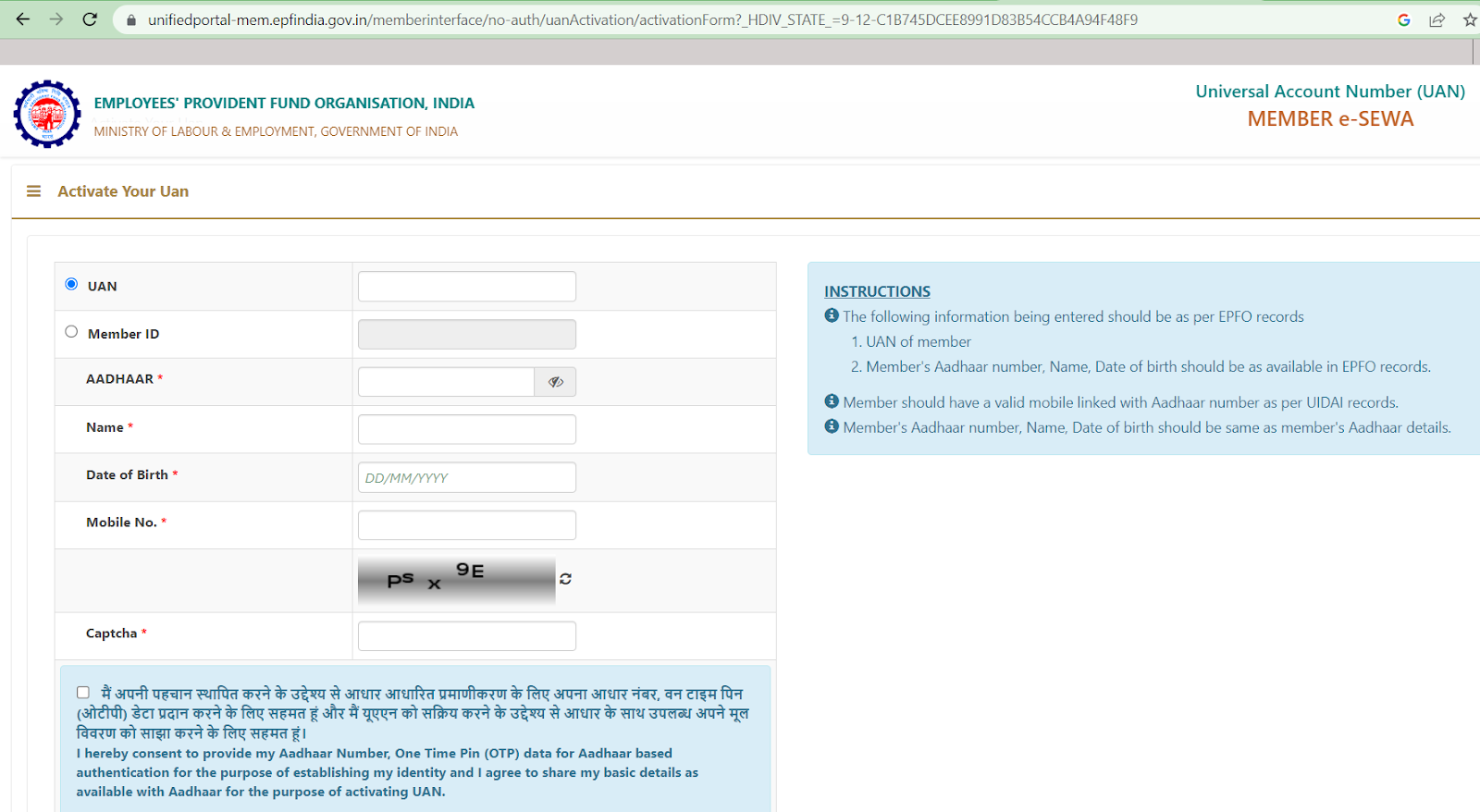

Step 1- Activate UAN: Make sure your Universal Account Number (UAN) is activated. The UAN is provided by your employer and is required for online PF transactions.

Step 2- Login to UAN Portal: Visit the UAN portal of the EPFO website (https://unifiedportal-mem.epfindia.gov.in/memberinterface/) and login using your UAN and password. If you haven’t registered, you can do so by clicking on the ‘Activate UAN’’ link on the portal.

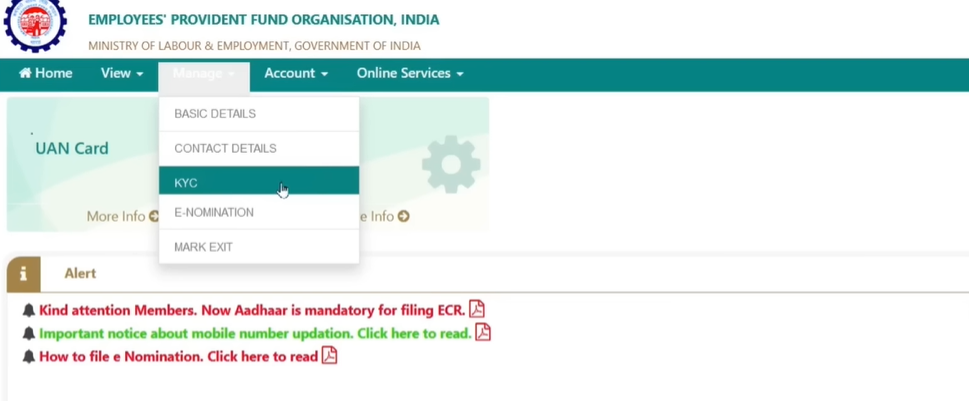

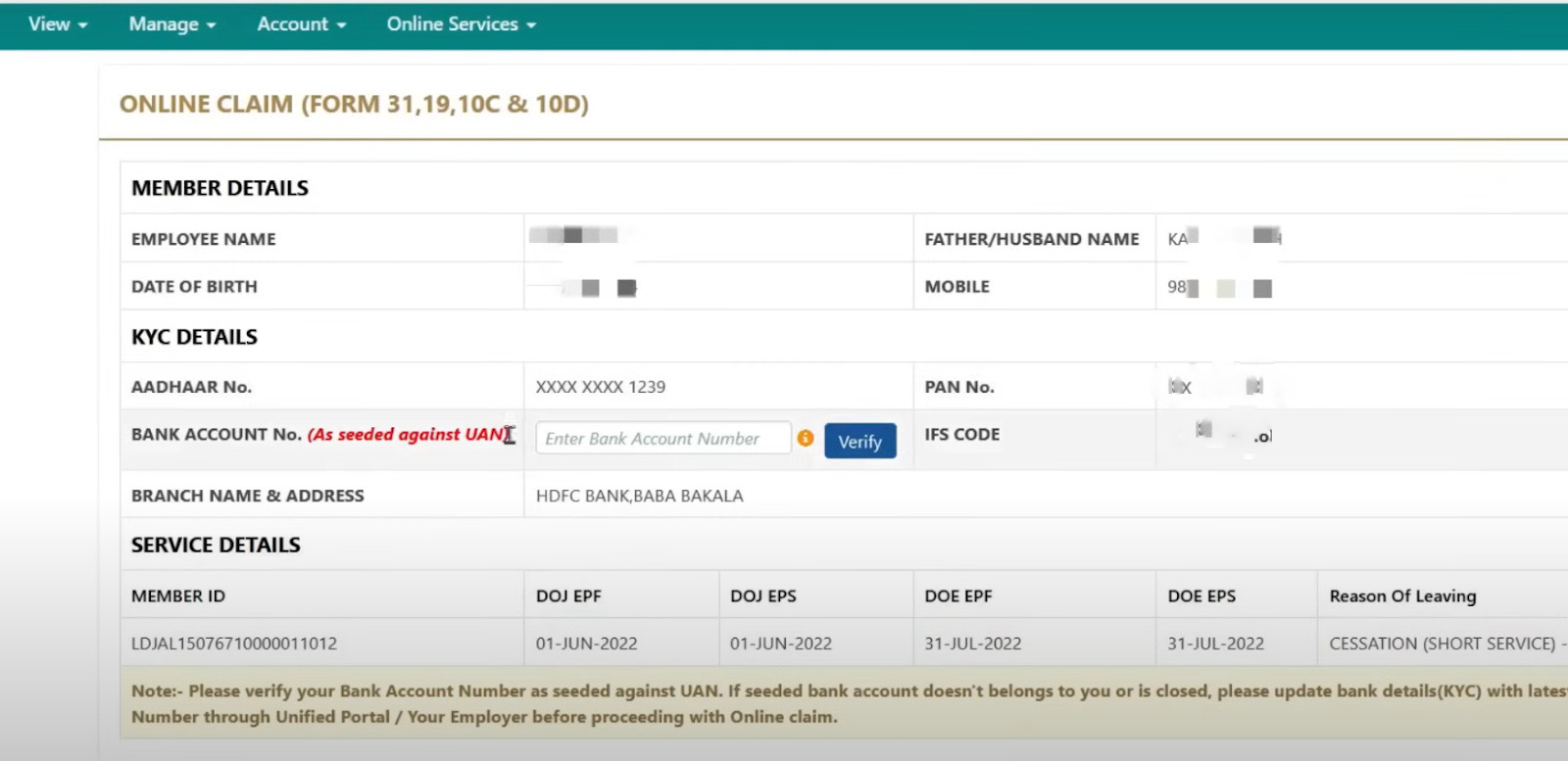

Step 3- KYC Verification: Ensure that your Aadhaar, PAN, and bank account details are linked and verified in the UAN portal. This is crucial for KYC compliance.

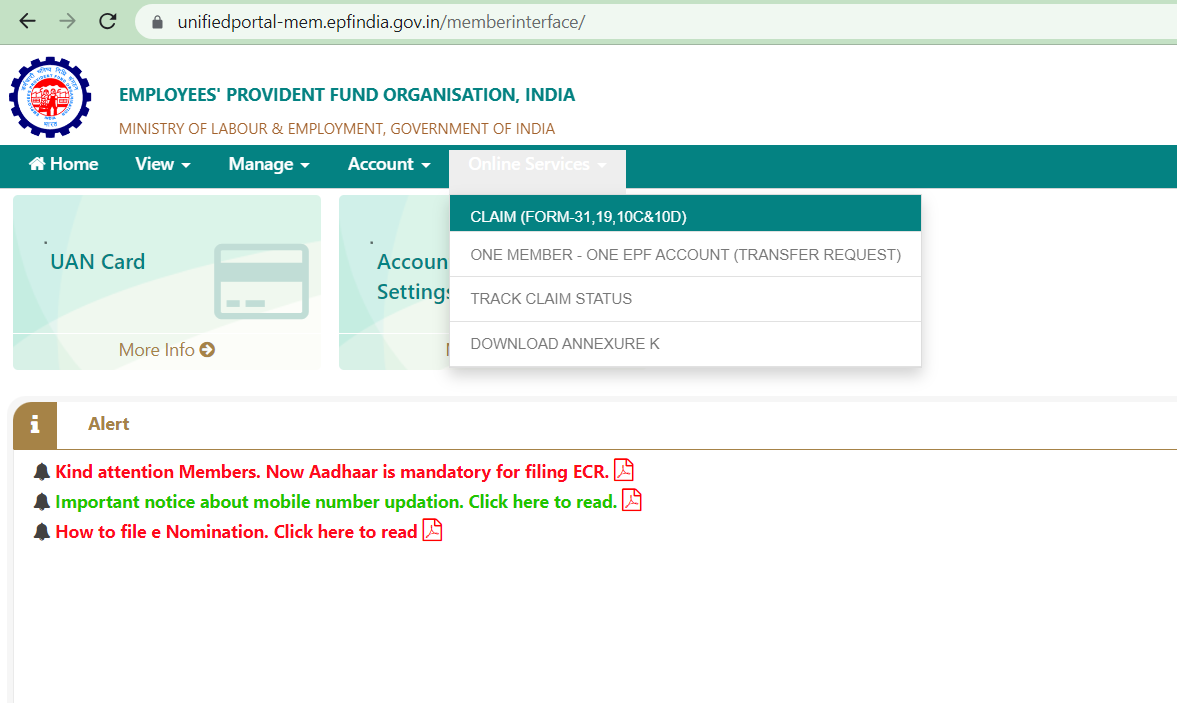

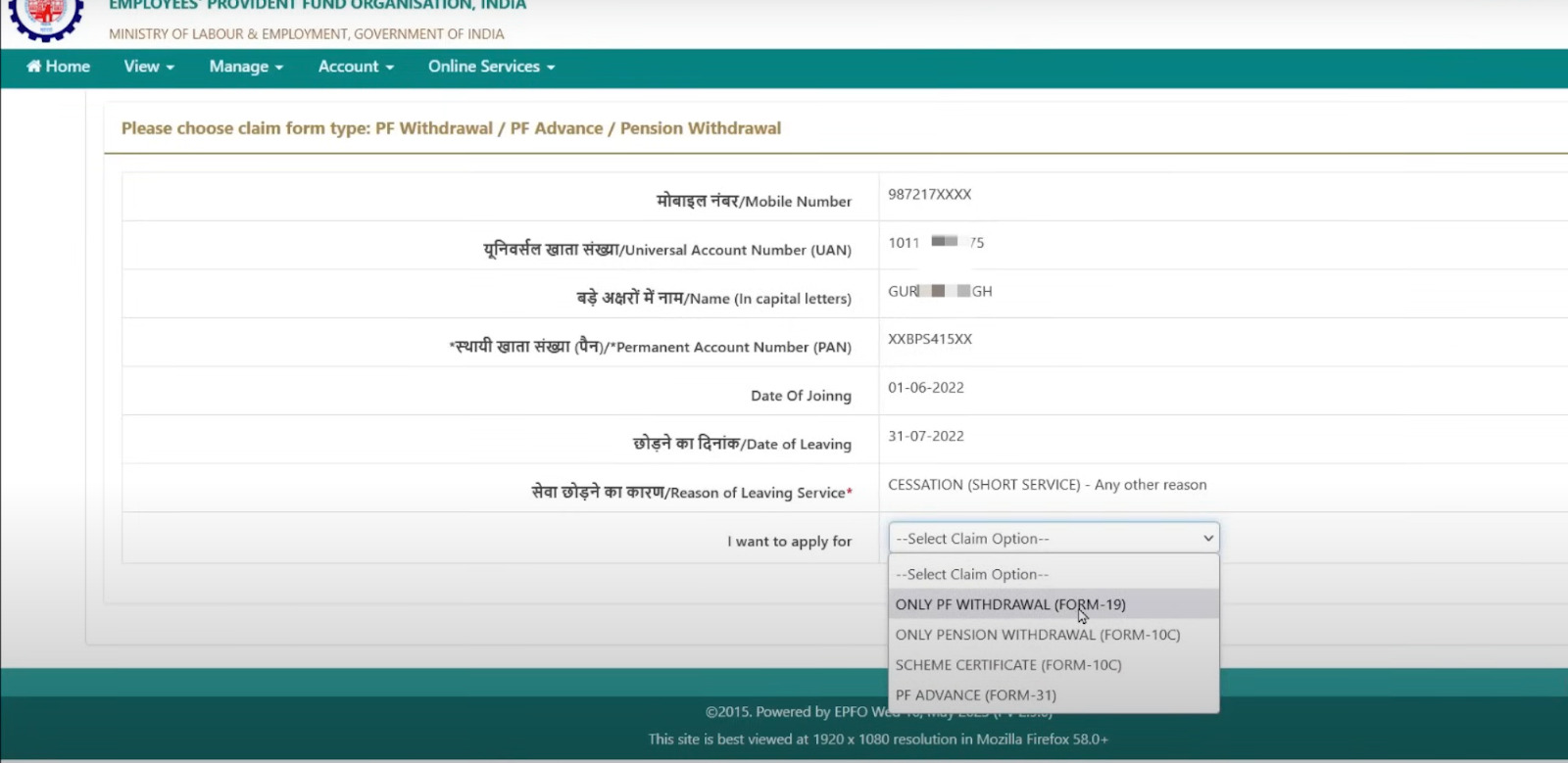

Step 4- Verify Details: After logging in, go to the ‘Online Services’ tab and select ‘Claim (Form-31, 19 & 10C)’. Your personal details will be displayed. Verify and confirm them.

Step 5- Select Reason for Claim: Choose the claim option for PF withdrawal, pertaining to Form 19.

Step 6- Bank Account: Confirm your bank account details for the PF withdrawal.

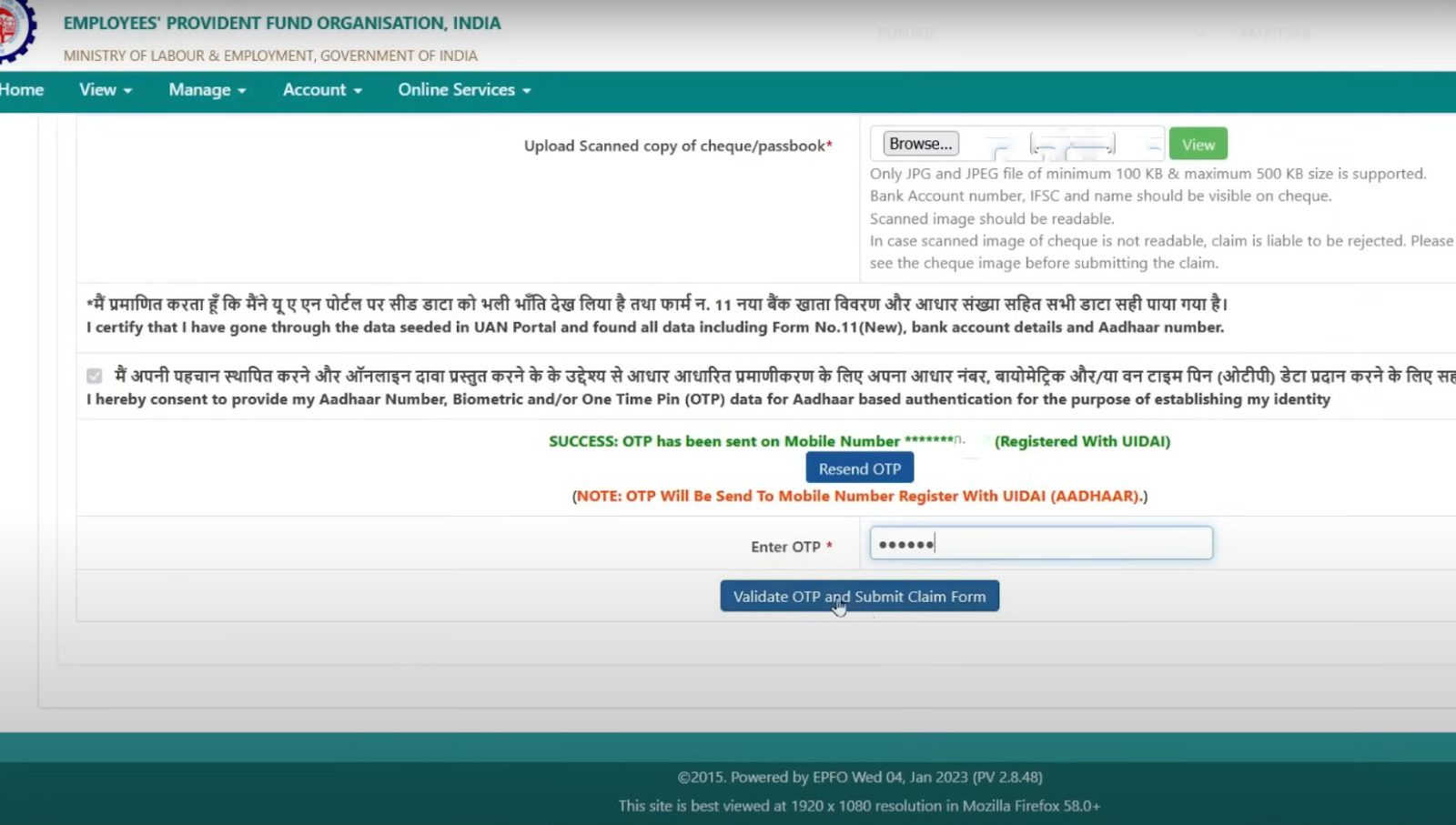

Step 7- Submit Claim: Once all the details are verified, submit your withdrawal claim. An OTP (One-Time Password) will be sent to your registered mobile number. Enter the OTP to verify your claim.

Step 8- Claim Processing: The claim will be forwarded to your employer for approval. If the employer doesn’t take any action within a certain time frame, the claim will be automatically processed by the EPFO.

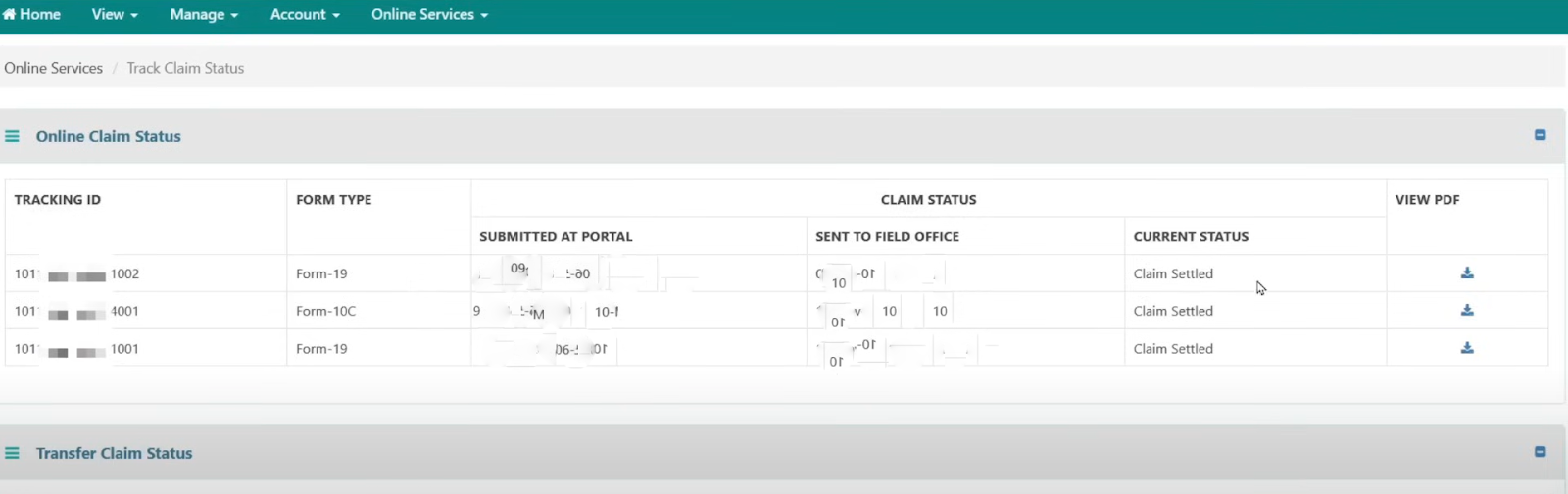

Step 9- Track Claim Status: You can track the status of your withdrawal claim online using the claim reference number on the EPFO portal.

Withdrawing PF Amount from using UMANG App

The UMANG app was introduced as a part of the Digital India initiative by the Government of India. The goal of the UMANG app is to provide a single platform for citizens to access a variety of government services.

Accordingly, you can apply for PF withdrawal through the UMANG app. Follow the given steps and you can get your PF amount with a few taps:

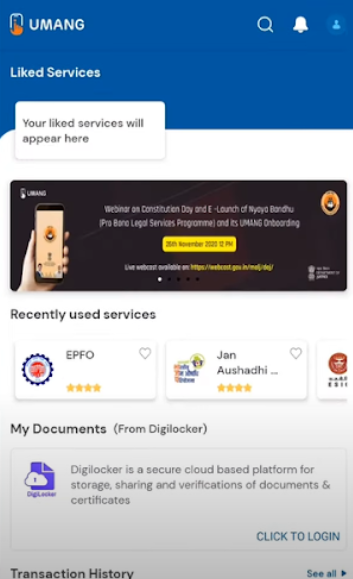

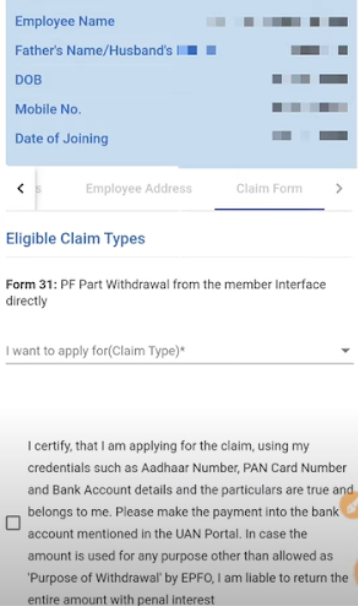

- Download and open the UMANG App on your handheld device.

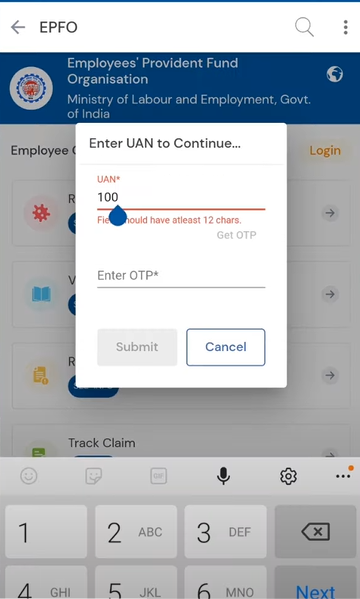

- Open the app and sign into your EPFO account using your UAN number and OTP sent to your phone number.

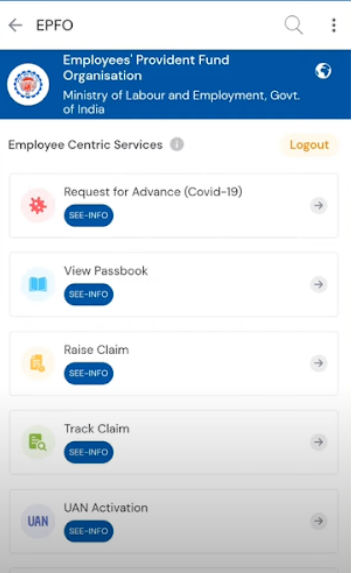

- After logging in, select the ‘EPFO’ service from the list of services.

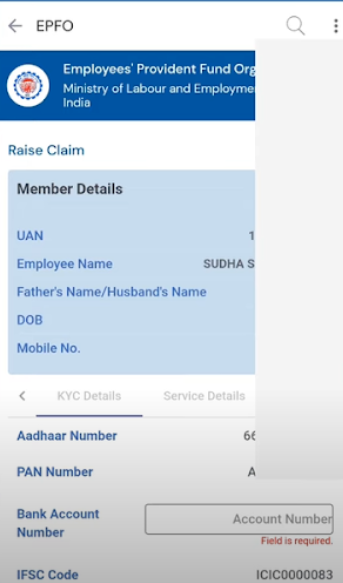

- From the list of services provided, select the ‘Raise Claim’ option.

- Enter the required details, like your employee bank account number, address, and other details.

- Select the type of withdrawal you want to make and mention other details, like the amount and purpose.

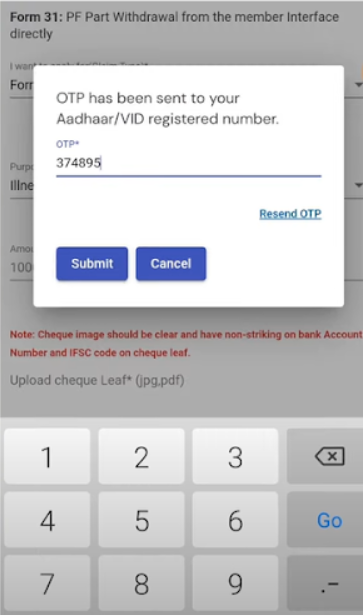

- To submit the claim, you will have to confirm the same with an OTP.

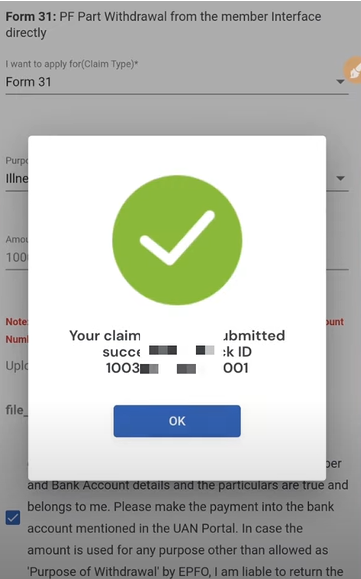

- After you submit your claim request you will receive a corresponding acknowledgment message and number.

Conclusion

Withdrawing PF amounts in India can be done through various methods like offline submission, online application through the EPFO website, and using the UMANG app. Each method caters to different circumstances, providing you with flexibility and convenience based on their eligibility and reasons for withdrawal.

As a crucial financial safety net, the EPF scheme empowers individuals to access their funds when needed, ensuring financial security during retirement, emergencies, and other essential life events.