Check Credit Score

CREDIT score is a numeric representation of an individual’s financial history and it is a statement of your creditworthiness. CREDIT score analyses the applicant’s income, expenses, credit history, borrowings, and the repayments on the borrowings. You must, therefore, check your Score to get to know your creditworthiness. The credit score will also affect your standing with banks and NBFCs when it comes to them lending you money. Apart from that, if you have a lower score, corrective measures can be taken to fix it and improve your CREDIT score.

CREDIT score ranges between 300-900. The ideal score an applicant can get is 675 and above.

With Finnable, you can check your credit score report free of cost.

read more

Every credit card holder should pay attention to their credit score as it reflects the worthiness of a credit card holder. It is a three-number credit score that ranges from 300 to 900. This score is very important if a credit card holder wants to approve any loan. The higher the score is, the higher the chances of getting your loan approved by the banks. This score is based on a level analysis of a person’s credit files.

With Finannable, you can get the best loans possible with impressively low interest. Not only that, but you can also do a cibil score check online easily from our website. This score will help you to estimate the chances of loan approval. This score reflects the ability of the credit card holder to repay the borrowed amount, and if your credit score is too low, there are chances that your loan will not be approved.

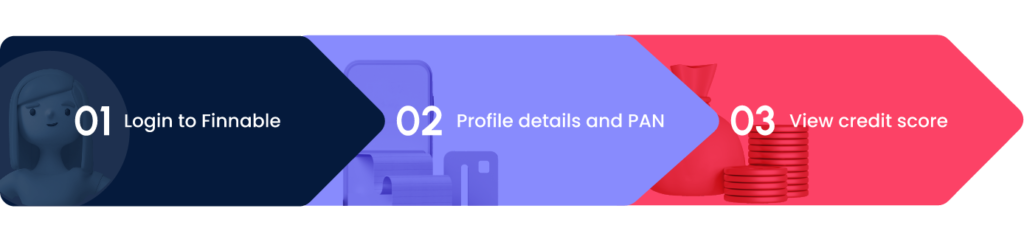

Simple 3 Step process to check Credit Score

Steps to Check Credit Score for Free

Here is how you can check cibil score online by going through a few simple steps.

- First, log into the official cibil website

- Here, you will need to create your account, and for this purpose, you will need to input your mobile number, email ID, and other information.

- You’ll get an OTP on your number or email ID that you will need to enter to open your account.

- Now, you will need to go to the dashboard section to check your cibil score.

- From this section, you will be taken to mysore.cibil.com. Here you can easily do a cibil score check online for free.

Besides that, you can also check cibil score online more hazard-freely by logging into the official website or application of Finnable. Here are three simple steps for that-

- Login to Finnable

- Enter your details and pan number

- View your credit score.

What you should know About your CIBIL Score?

Cibil score is an external important factor. Not only because it reflects the reliability of the credit card holder but also because a credit card holder needs a good score to get approval for any personal loan. Here are some factors that can affect your credit score, and you should know about that

- Irresponsible Payment Behaviour

- High Credit Utilisation Ratio

- Outstanding Debt

- Paying only the Minimum Amount Due

- Making Multiple Credit Applications

- Errors in your CIBIL Report

- Not Having a Credit Mix

- Length of the Credit History

How Credit Score is Calculated?

The cibil score is calculated depending on different factors. Here we have mentioned which factor plays which role in your credit score calculation

- Repayment history – 35%

- Type of ladies taken for repayment duration- 10%

- Existing debt and credit utilization- 30%

The number of credit inquiries, especially the unsuccessful ones- Every unsuccessful credit inquiry will lower your credit score.

Benefits of Having a Good Credit Score

There are several benefits of having a good cibil score range. Here are some benefits you can have if you have a good cibil score range.

- You can get better rates on car Insurance

- Save on different types of Insurance

- You can qualify for lower credit card interest

- Get approved for higher credit limits

- Get more housing options

- You can get some utility services more easily

- You may not have to make a security deposit or prepay to get a cell phone.

How to Improve your CIBIL Score?

The minimum cibil score for a personal loan is between 700-790. So, if you have a credit score that is lower than 700, the chances are that your loan will not be approved. However, you can increase your cibil score easily. Here is how to increase cibil score.

- Make sure to make your payments on time and be disciplined with your credit card

- Maintain an older credit card to make your card history longer

- Restrict your credit usage as far as The limit

- Avoid taking a huge amount of loan at the time

- Go for a longer tenor while taking loans

- Choose different forms of credit to make your credit history longer.

Credit Score Range and What it Means

The credit range decides the chances of getting a loan. Though credit range depends on the model of the credit card, the range is

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

Learn with Finnable

FAQs about Credit Score

You can check your CREDIT score online by visiting Finnable’s website. You will

need to enter your personal details along with your PAN number.

High CREDIT score helps lenders decide a borrower’s creditworthiness. With a high

CREDIT Score and report, there is a higher chance of the borrower getting his loan or

credit card application approved with lower interest rates. A high CREDIT score and

report will also help when it comes to availing of higher loan amounts or a credit card

with a higher credit limit from a bank or an NBFC.

A high CREDIT score has an array of advantages:

1. You can avail a personal loan of a higher amount.

2. Lenders can approve loans with a lower interest rate.

3. Borrowers can have a flexible repayment schedule.

With Finnable, you can check your credit score free of cost. Log on to Finnable, enter the

details required and get your free CREDIT score and report.

There are many reasons why your CREDIT score is not being generated:

1. If there is an error in imputing your data or information

2. You have not availed any credit in your name

3. Delayed payments are done by you during your repayment month

4. Incorrect account name

5. No PAN or bank details

Here are the 5 most important things that impact cibil score.

- Your payment history

- Your credit history length

- Your credit mix

- Accounts you own and

- How old is your credit card

The best credit range is above 700. If your credit score is between 650-700, it is still considerable, and loan companies can still review your loan application to decide whether they would give you the loan or not.

There are two types of enquiry that you can make: soft enquiry and hard enquiry. A soft enquiry is when you check cibil score online by yourself or you give permission to a loan lender to check it for yourself. A hard enquiry is when you apply for a loan and the lenders or the company view your credit. A soft enquiry does not have any negative impact on your cibil score but if you keep taking loans then it will affect your cibil score.

Zilch credit is when you do not have any credit card history, and for the same reason, you do not have any credit card score.

Yes. If you use your credit card too much or spend beyond the limit, it reflects that you are not responsibly taking care of your credit card. It can lower your credit card score, and that's why you should always take care of your credit card limit.

When you are credit hungry, there are possibilities that you will apply for loans in multiple places, and as a result, you will check your credit score multiple times. It will be considered high risk.